Markets show resilience over time, despite dramatic headlines

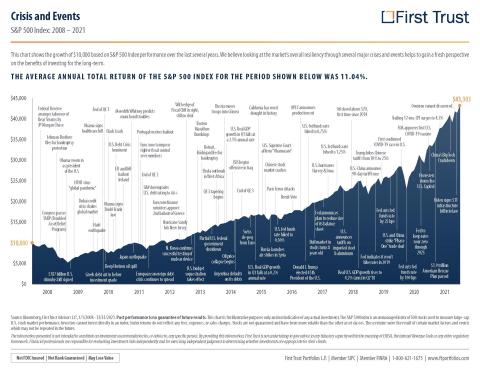

When the world wakes up to dramatic geopolitical headlines, like today’s unprovoked invasion of Ukraine by Russia, investors can get spooked. That fear often results in a sell-off and retreat into so-called “safe” investments like cash. The truth is major global or national events rarely change the trajectory of equity markets for a sustained period. The chart below shows the S&P 500 Index performance from 2008 through 2021, noting various events and their relevance on long-term returns:

Current economic conditions, where sectors such as financials, energy and industrials continue to thrive in a high-growth, high-inflation environment, tell us that the fundamentals underpinning the market are still sound. To discuss the strategic importance of adhering to your long-term financial plan, contact your Cranbrook Wealth investment professional.